Content

A company can exist only to the extent that it is able to generate sufficient revenues to cover all of its costs and provide a return to its investors. What’s more, revenues often provide an important indication of a company’s relative strategic position. Net income is the final calculation included on the income statement, showing how much profit or loss the business generated during the reporting period. Once you’ve prepared your income statement, you can use the net income figure to start creating your balance sheet. While single-step statements provide a simple overview, multi-step statements give a detailed breakdown of business operating and non-operating revenue and costs, such as gross profit and pretax income.

Learning to prepare an income statement is the first step in understanding how to read one. This may seem like a task best left to the accountants, but small business owners can benefit from the knowledge we are about to impart in this article. Expenses, commonly referred to as operating expenses, are costs the company incurs related to sales. These might include the cost of goods for resale, property rental, and the price of consumables like printer ink and stamps.

Income Statement vs. Statement of Other Comprehensive Income

Conceptually, the income statement is very straightforward, but it does use specific terminology that needs to be clarified. Start with gross revenue, the total amount of revenue derived from sales of products or services. Subtract the cost of sales or cost of goods sold , expenses directly related to producing the company’s product or service (e.g., raw materials or the labor involved). The income statement is one of three statementsused in both corporate finance and accounting. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner.

- Along with the cash flow statement, they comprise the core of financial reporting.

- An income statement (also called a profit and loss statement, or P&L) summarizes your financial transactions, then shows you how much you earned and how much you spent for a specific reporting period.

- This reading has presented the elements of income statement analysis.

- Income statements are used to track the ongoing finances of the business and analyze profits, losses, and other outcomes of past investment decisions.

The first part of a what is an income statement flow statement analyzes a company’s cash flow from net income or losses. For most companies, this section of the cash flow statement reconciles the net income to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items and adjusts for any cash that was used or provided by other operating assets and liabilities. Moving down the stairs from the net revenue line, there are several lines that represent various kinds of operating expenses. Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales.

Step #5: Factor in total operating expenses

Are these changes likely to have a long-term impact or only a short-term one? Is the company gaining market share or losing it relative to its competition? Is there disruptive technology that the company should be concerned with?

Non-operating revenue comes from ancillary sources such as interest income from capital held in a bank or income from rental of business property. Microsoft had a lower cost for generating equivalent revenue, higher net income from continuing operations, and higher net income applicable to common shares compared with Walmart. A balance sheet is comprised of your assets, liabilities and equities. Below the net income figure, you will find a separate section called “Statement of Other Comprehensive Income.” It summarizes transactions that do not arise from the normal course of the business. As such, they do not affect the stock owners’ equity but not the net income. We can define expenses as the outflow of economic resources that occurs in the normal course of business activities.

Tips to improve your income statements

These include the net income realized from one-time nonbusiness activities, such as a company selling its old transportation van, unused land, or a subsidiary company. Revenue realized through secondary, noncore business activities is often referred to as nonoperating, recurring revenue. Corporations are required under GAAP accounting rules to use the accrual method to keep track of incoming revenues.

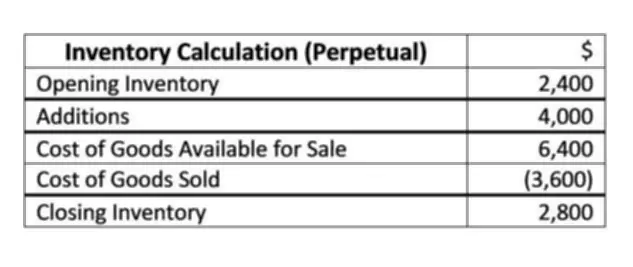

Because of these noncash expenses, not uncommonly companies experience significant operating losses during economic downturns, while at the same time generating positive cash flows from operations. As companies get larger, they start making a few common variations on the structure. Many, for example, have a section at the top that starts with total revenue, then subtracts “cost of revenue” and shows the difference as “gross profit”. The “cost of revenue” line is the total of all expenses the company deems to be directly related to generating the revenue, such as the cost of purchasing inventory.

Example of a Retail Store Cash Flow Statement

The income statement reports on activity over a specific period of time, based on the transactions that happened during the period. Judgment must be used when a transaction started in one period but was completed in a subsequent period; simply put, in which period should we report this transaction? In some cases, this is easily determined; for a retail store, revenue is recognized when the customer pays for and takes the product. For example, a technology firm may provide an integrated solution to its customer that takes three years to implement; clearly, how the total project is spread over the three years is a subjective matter. This article is the second in a series designed to help you make sense of your practice’s financial statements. In the first article, we examined the balance sheet as a snapshot of your assets, liabilities and equity at a particular point in time.